Our thanks to Roditis Yachting Agency (Rhodes/Simi) for their assistance in confirming the facts in this report.

The Complexities of Greek Clearance

Greece has always stood out from other EU countries as being “outside the norm” when it comes to yacht clearance formalities. With one set of rules for EU yachts (although different ones for Polish yachts) and another for non-EU, it can be tricky to know exactly what rules apply to you.

It also doesn’t help that Greece is not just the mainland, it’s also made up of nearly 6000 islands with an abundance of ports of entry [Port Authority Index | ΛΣ-ΕΛΑΚΤ] stretching several hundred nautical miles across the eastern Mediterranean. Consequently, what rules are enforced in one port, may well not be in another.

A number of reports from cruisers clearing into Greece have been received over the last few weeks, all highlighting problems that are occurring this year and may take some time to be resolved. Yachts planning to head to Greece should be aware of the following:

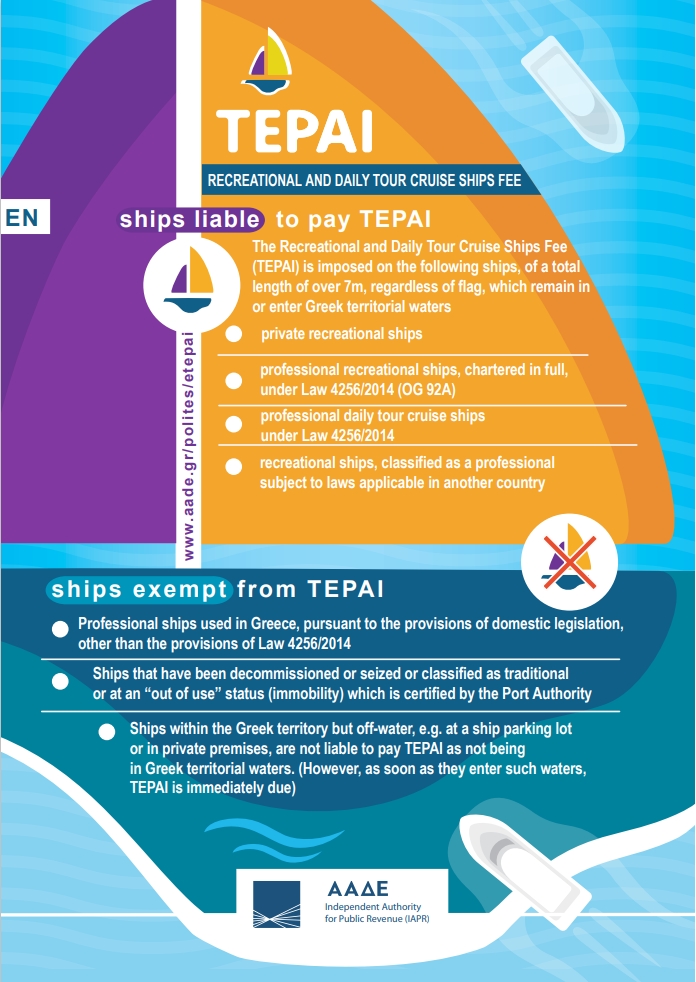

E-Tepai – Apply in Advance

This is the Greek cruising tax payable by all vessels over 7m and MUST be applied for online prior to arrival. Cruisers are still reporting having issues with payment and we’ve included some useful links at https://www.noonsite.com/place/greece/view/documents/ to help with this. However, it does not appear to be a problem paying for the E-Tepai on arrival and no yachts have reported being penalised for this.

Find out more about the E-Tepai here.

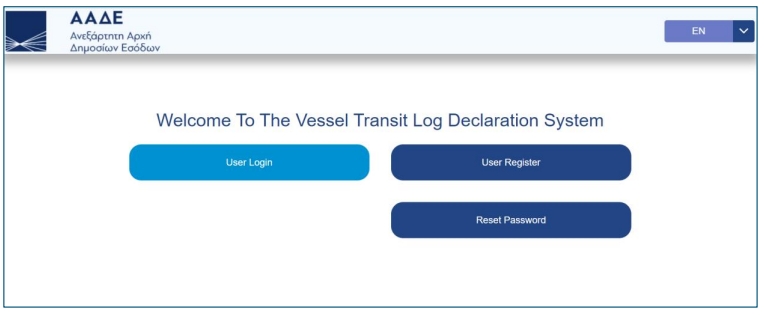

Transit Log – Apply Online

The Transit Log (TL) process has now been moved online, in an attempt to make the application process simpler. All non-EU yachts (and Polish yachts if not EU-VAT-paid) must get one.

Skippers should apply online prior to arrival, or prior to starting the paperwork upon arrival, and wait for the Transit Log approval. They will receive a message to visit Customs for the fee payment or for additional documents required.

Find out more about Transit Logs here.

While the online transit log was launched to help boaters, unfortunately there is not an extended hours central support and applicants must wait for approval or visit the Customs office at the port of entry.

It appears that some ports are now giving fines (300 Euros) to skippers who have not applied for the TL in advance online (Agios Nikalaos being one example).

SY Aliana recently had to divert into Greece due to bad weather whilst on passage to Malta from Cyprus. They arrived on Good Friday afternoon into Agios Nikalaos Marina. They were able to apply for the E-Tepai online, however were unable to work out how to make the payment (in the end they were able to pay Customs on arrival). They assumed they could apply for the Transit Log in person, however, when Customs opened on the Tuesday morning the officer told them they should have applied online before arrival (despite their predicament). They were fined 300 euros.

To avoid any problems, cruisers should apply for the TL as well as the E-Tepai online before entering Greek Waters.

Unlimited Transit Log (UTL)

This is granted to vessels bearing the flag of a non-EU country, that can demonstrate the status of Union Goods (i.e. EU-VAT-paid). It gives unrestricted cruising time in Greece (unlike the normal 18-month TL).

It does appear that this year many cruisers are having problems securing a UTL as Customs/Port Police offices are being strict about exactly what documents are shown as evidence of EU-VAT-paid.

It has been confirmed that proof of VAT should be an official Customs Document with MRN number, or a T2L.

Proof of VAT-Paid

The Proof of Union Status system (PoUS), introduced last year, means that Greek Customs are now rigorously checking all yachts arriving in Greece from outside the EU, as well as all non-EU yachts applying for a Transit Log, for proof of VAT status. Increasingly, all vessels are being checked, so make sure you have the correct paperwork on board demonstrating your VAT status, whatever the flag of your boat.

Most Customs offices (and yacht agents) have asked Athens Head office of Customs & Excise for clarification about what certificates etc. should be accepted as proof of VAT payment. This is on-going, however, for now most Greek Customs currently stipulate that only an official Customs Document with the MRN number or a T2L is acceptable. The MRN number is easily searchable for new boats and for older boats can be confirmed via an email between the EU designated offices for cross border assistance.

If the yacht owner only has invoices or other evidence of payment, it will depend on the discretion of the TL handler (Customs officer) to accept this proof or not. An experienced Customs Officer may accept other forms of proof and exclude the yacht from the Transit Log and the yacht will continue unrestricted in Greece, however in most cases they will issue a 30-day TL until approval of the VAT status of the yacht has been obtained.

Customs brokers can assist with obtaining a T2L, and in the UK the RYA can assist yacht owners with obtaining the same.

No Common Rules Governing all Ports

Roditis Yachting Agency, based in Rhodes/Simi, have assisted Noonsite with getting these details confirmed and explained;

“Unfortunately, the AADE (Independent Authority Of Public Revenue) is becoming more and more involved in the yachting sector and this is a major issue as they have no idea about yachting and no flexibility to understand anything.

“One of the biggest issues which we face in Greece is the fact that there are not common rules to govern all ports and what is granted in one port may be impossible in another.”

Roditis recommend that the less complicated entry ports for yachts seem to be Leros and Kalimnos in the Dodecanese and Corfu and Cefalonia in the Ionian.

It is hoped that during May better clarification from Athens will be received, making the paperwork easier for yacht owners.

All boaters who have similar problems with Customs to those reported in this article, should write a formal email to Central Customs Supervision: ddtheka@aade.gr

As requirements are so varied across Greece and in many places are tightening up, if your situation is outside the norm it may well be advisable to employ an agent to assist with your inward clearance and pre-arrival requirements, to smooth over any issues.

…………………………………

If you have found this information useful, become a paid member to enjoy unlimited use of Noonsite plus many other perks. Your membership fees really help our small, dedicated team keep country information up-to-date in support of cruisers worldwide. Find out more about Noonsite Membership levels and benefits here.

Subscribe to our FREE monthly newsletter: https://www.noonsite.com/newsletter/

Leave a comment

You must Login or Register to submit comments.

We entered Greecefrom Turkey. If possible applying for a transit logshould be done on computer. If not available, a smart phone can be used. However you cannot see what you are writing or delete if you make a mistake.this means restarting thr process all again. I managed but not easily. You must have a phone number

Thankyou for these useful tips!